Could this be the end of a long soap opera? In fact, the Portuguese Socialist Party has decided to go ahead with its ambition to reform the status of non-habitual resident, and this this year through the Portuguese state budget 2020. The bill indicates that future retirees benefiting from non-habitual resident status will no longer have the right to a total tax exemption and will have to pay a tax of 10% on foreign pensions. The idea of applying a minimum amount of 7,500 euros was not retained. This proposal is likely to be adopted this year as the forces inciting a modification or even a cancellation of the NHR statute are strong. Lisbob, the expatriate assistant in Portugal, tells you all about the changes in NHR status.

NHR status: Portuguese government decides to tax retirees at 10% IRS and abandons the minimum amount of 7,500 euros

Retirees from abroad who will obtain non-habitual resident status in Portugal in the future will be subject to a tax of 10% in place of the current total exemption. The rule does not apply to current beneficiaries of NHR status and leaves aside those who already benefit from it or who are in the process of joining this scheme.

With these new rules proposed by the Portuguese Socialist Party in the list of proposals to modify the state budget for 2020 and, as Lisbob announced two weeks ago, Portugal shows the intention to calm internal critics and growing externalities that have been heard with regard to these tax advantages and, at the same time, not to scare away the wealthy foreigners.

Portuguese government intends to tax the pension income of anyone who in the future will join this NHR scheme at an IRS tax rate of 10%. The idea of imposing a minimum tax of 7,500 euros per retiree who, as we had advanced, was on the table, ended up being abandoned in the final version, allegedly so as not to harm the Portuguese emigrants who return from the foreigner and bring their pensions, and who can benefit from this exemption but who tend to have more modest pensions.

The rate of 10% is per retiree. The tax credit method also applies, which means that, if the retiree pays the IRS abroad, they can deduct the tax they will pay in Portugal.

The new NHR status is still a good incentive with a flat tax of 10 % on foreign pension.

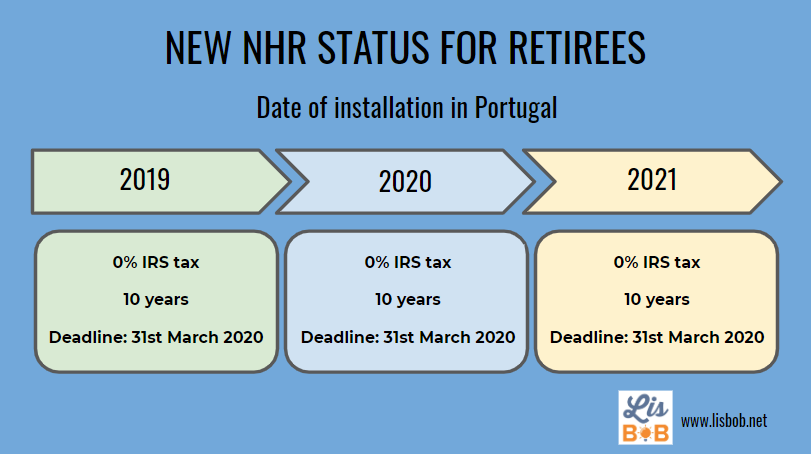

The new rules do not apply to all those "who are already registered as non-habitual residents", those whose "registration request has already been submitted and is awaiting analysis" and who "on the date of entry into force of the law is considered a resident for tax purposes and possibly applicant for registration as a non-habitual resident until March 31, 2020 or 2021, to fulfill the respective conditions in 2019 and 2020 ”.

However, if these taxpayers wish to be taxed at the rate of 10%, they can choose to do so on a voluntary basis. This situation can be particularly advantageous for retirees who are threatened with being taxed in their country of origin, such as the Swedes and the Finns, because the 10% rate required here may be more favorable to them.

Non-habitual resident status emerged from the PS in 2009, Teixeira dos Santos was then Minister of Finance and Carlos Lobo was his right hand in tax matters. At the time, the program was sold as a way to attract highly skilled brains to Portugal, in exchange for a reduced rate of 20%. However, an even more generous framework has been put in parallel for foreign retirees, which for years has gone relatively unnoticed: retirees who obtain this status do not pay tax in Portugal on the pensions they receive from their country of origin due to a "dormant rule", which appears in most tax treaties.

In view of the statistics, it appears that it is this double exemption for retirees that ended up attracting so many foreigners. Indeed, of the approximately 30,000 beneficiaries of NHR status, only 7% are highly qualified workers. And it is also this double exemption that has started to create diplomatic conflicts with the countries with which Mário Centeno sits every month in the Eurogroup and which accuse Portugal of promoting an aggressive and unfair regime.

With this measure, the Portuguese government is trying to put an end to the criticisms that it promotes a regime based on aggressive tax competition, while preserving the regime, and without harming the interests of those who are here. Also, this 10% rate will not scare foreign retirees.